‘The big Australian club’ does as it pleases.

TAX LOOPHOLE EXPOSED

For a quarter of a century, a peculiar loophole has kept the financial affairs of some of Australia’s richest people safe from public scrutiny, including by government tax entities.

Almost 1,500 companies, controlled by rich Australians like Perth media billionaire Kerry Stokes, Melbourne packaging clan the Pratts and Sydney’s Belgiorno-Nettis family, are exempt from laws that require other large enterprises to file financial records that are available to the public.

These large proprietary companies continue to enjoy a privileged exemption from having to lodge financial reports to the Australian Securities and Investments Commission (ASIC):

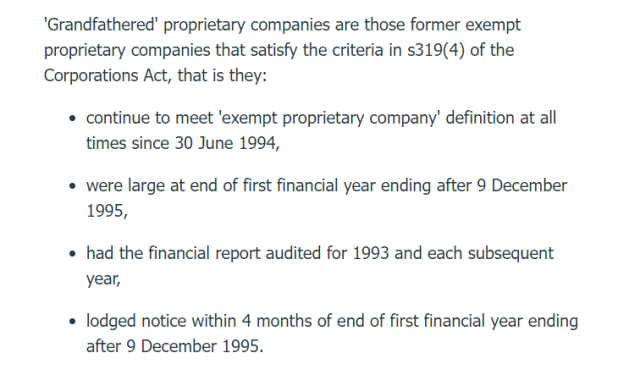

Known as ‘grandfathered proprietary companies‘, ASIC defines these organisations as large entities that remained exempt to reporting requirements when the law came into effect in 1995.

These are the ‘old wealth’ empires of Australia, shadowed from the public eye, with their financial accounts cloaked to ensure the continuation of their corporate monopolies.

“It’s a loophole which effectively means that they are different from other Australians, financial apartheid if you like”, said Michael West on latest failed attempts to close the loophole in August.

“Unlike all other Australians, some billionaires and other wealthy citizens don’t have to publicly disclose their financial accounts and tax affairs, which may involve any sneaky offshore entities.”

Plans to introduce new legislation was just the latest in a series of failed attempts to kill the loophole stretching back more than a decade, including criticisms from Australia’s Treasury.

Treasury officials said in a paper calling for submissions to a review of the loophole in 2012.

“The relief granted to grandfathered exempt proprietary companies creates an inconsistent regulatory framework for proprietary companies that potentially gives grandfathered exempt proprietary companies an unfair competitive advantage.”

Those who want to keep this loopholes alive say it’s a valuable privacy measure that helps allay the fears some rich Australians have for their personal safety. This is the official reason.

They should ‘let them get on with life outside of the limelight’, they argue, citing security reasons.

‘We can’t have Australians finding out about our affairs! What if they come for us!’

The financial elite of Australia don’t need to play funny games, as they are allowed to remain exempt.

HOW IT WORKS

What was initially issued as a “temporary measure” by the government of Paul Keating in 1995, has now placed these companies above the law for more than 25 years.

The ‘no-tell club’ is made up of companies that were already large in 1995, but did not have to file accounts with the Australian Securities and Investments Commission under the law at that time.

When new rules were introduced, these firms were allowed to keep their secrecy status.

Through large lobby incentives from large corporations, Australia’s political arena has continued to avoid passing new laws that address these inequalities, allowing the farce to continue for decades.

So much so, that the rules have been long enshrined in the Corporations Act 2001:

The explanatory memorandum for the Bill notes:

“To avoid disrupting established commercial arrangements, those existing exempt proprietary companies which have their annual accounts audited, which are large and which elect to continue operating under the existing rules, will not need to lodge their accounts with [ASIC].”

In other words, a financial apartheid was developed in Australia, separating the ‘old rules’ from the ‘new rules’. Only the peasants earning under $5 million per year turnover were made to comply.

Since 1995, the need transparency has only increased, driven in part by revelations of widespread tax dodging by multinational companies and the use of offshore havens by the world’s financial elite.

COVID has all but confirmed the need for assistance from the financial powers in Australia.

Yet, they continue to protect their cloak of secrecy, while profiting off the manufactured crisis.

THE RICH GET RICHER

While the pandemic raged, the country’s richest people became vastly richer.

Australia’s richest billionaires have recorded a $55 billion increase in wealth during the first 12 months since the COVID-19 pandemic was declared.

The individuals and families on the 2021 Rich List commanded a combined total $479.6 billion fortune, up from $424 billion six months earlier.

To put that into some perspective, the Australian Government general government sector recorded an underlying cash deficit of $134.2 billion in 2020‑21.

Gina Rinehart was already the country’s richest person before she accumulated an extra $US17.8 billion ($23.4 billion) between March and December 24 of the recording period.

An Oxfam analysis found that that increase in wealth would be enough to give Australia’s poorest 2.5 million people a payment of more than $33,300 each, and that as Australia battles the COVID-19 downturn, that wealth gap was “particularly shocking”.

“As hundreds of thousands of people were losing their jobs and entering an incredibly unstable employment market, this small group of elite Australians saw their incomes recover very quickly, before beginning their upwards trajectory once more,” Oxfam Australia Chief Executive Lyn Morgain said.

Morgain said the Australian government’s decision to end the JobSeeker supplement is a “cruel blow” and will leave 1.4 million people living on $40 a day.

“We stand to witness the greatest rise in inequality since records began. The deep divide between the rich and poor is proving as deadly as the virus.”

Globally, the 1,000 richest people recovered their COVID-19 losses within nine months. However, the world’s poorest people will need a decade to return to their pre-pandemic financial position.

The world’s richest 10 men have seen their combined wealth jump by half a trillion dollars.

It’s a big club, ladies and gentlemen — and we ain’t in it!

KEEP UP-TO-DATE

For more TOTT News, follow us for exclusive content:

Facebook — Facebook.com/TOTTNews

YouTube — YouTube.com/TOTTNews

Instagram — Instagram.com/TOTTNews

Twitter — Twitter.com/EthanTOTT

When trying to get to the bottom of what’s going on regarding this ‘plague’ supposedly doing the rounds…it doesn’t take long before one hears the sound of cash registers…many of them…wealth transfers fueling the fire…the best plan of action may be to just get out of the way and hope that this thing burns itself out soon! (then comes the next attack, whatever that will be)

This is nothing new. The Tax system was re-introduced by Rome after having first been originally imposed by the king of Babylon and suppressed by the Cyrus the Mede.

The bible makes it clear in Luke. It came to pass in those days, that there went out a decree from Caesar Augustus, that all the world should be taxed. (And this taxing was first made when Cyrenius was governor of Syria.)

A look at history is enough to show that it repeats itself. When the Reformation was rejected by France, the tyranny of the monarchy knew no bounds. Two thirds of the land of the state was in the hands of the clergy and nobles ; the king passed laws taxing his subjects against all protests from Parliament ; warrants for arrest and imprisonment were issued by his authority alone ; ” famine prevailed in every province, and the bark of the trees was the daily food for hundreds of

thousands.” The oppression was unendurable, and men, frenzied until they were more demon

than human, rose in revolt.

The purpose of the taxation was not to help the poor or to help those in need but it was a method for the head of states, Kings and Emperors to enrich themselves and gorge in the riches of the world at the expense of the less fortunate. Today the Babylonian educational system is still the one now generally accepted ; her government, with its excessive taxes, its exaltation of the rich and the oppression of the poor, its pride, arrogance, love of display, its choice of the artificial in place of the natural, and the exaltation of the God of science instead of the God of heaven, is the one toward which the world of to-day is hastening.

Nothing has changed as Rome never changes. Is what is going on in the world today surprising anyone? If it does then don’t be. History is a clear indication of what is happening again.