New reports released by payment industry bodies have revealed Australia’s shift to a digital economy is accelerating, with increasing cashless payments outperforming continuing declines of cash and cheque at an unprecedented rate.

As the trend towards a cashless era continues in Australia, Ethan Nash takes a look at an emerging society that will see the future dollar issued and used with no tangible representation.

DIGITAL ECONOMY >

CASH ECONOMY

Now valued at an estimated $79 billion per year, the digital technology industry – including payless, instant transactions – has become the new phenomenon of the sweeping impact of the internet.

Rapidly evolving from basic connectivity, these technologies are changing not only how consumers interact with businesses, but also how businesses are organising themselves, subsequently leading to a transformation in value-based exchange never seen before in human history.

According to a new report by the Australian Payments Network, the payment industry self-regulatory body, the amount of people paying with cash has dropped from 69 per cent of Australians in 2007 to only 37 per cent in 2016.

Consumers are embracing e-commerce like never before, with 72% purchasing online in 2016-17, compared to 61% two years earlier.

Furthermore, a record 14.4 million people shopped online in December 2017, and online spending exceeded $25 billion in the 12 months to February 2018. Spending in February 2018 was also up 15.1% on the previous year.

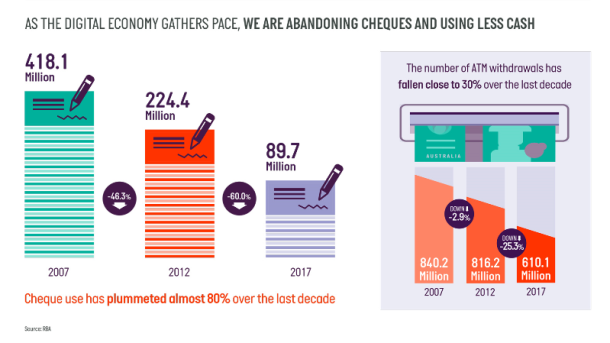

This growing consumer preference for digital payments is reflected in a rapid decline in cheque use and ATM withdrawals, which together accounted for fewer than two million transactions a day in 2017.

This is compared with almost 23 million each day in 2018 via the digital economy:

The report also details things such as the rise of the digital card over the last few years, transfer and logistic statistics, and a look at future directions given this increase in consumer behaviour.

AusPayNet CEO Leila Fourier recently commented on the 2018 report:

“The continued shift to digital payments is not surprising given how connected and mobile our society is.

Almost 9 in every 10 Australians own a smartphone, and more than 3 in every 5 use them to make payments. This is driving uptake in digital payments and laying down a powerful base for the next wave of payments innovation.”

This notion was confirmed by Reserve Bank of Australia governor Philip Lowe, who recently commented on the report, as the Federal Government considers imposing tougher penalties on cash economy activity:

“It looks like a turning point has been reached. It is now easier than it has been to conceive of a world in which banknotes are used for relatively few payments; that cash becomes a niche payment instrument.”

According to an article published by Australian Financial Review, if the digital economy was an industry, it would be larger than Australia’s agriculture, transport or retail industries, estimated to hit $139 billion or 7.3 per cent of GDP by 2020.

The study also estimated that the Australian economy was $45 billion bigger in 2013 than it otherwise would have been because of the positive impact of digital technologies on productivity.

As the digital economy continues to grow and contribute to Australian society like never before, as is evident by the findings above, what lasting effect is this growth having on current functions of society?

ADAPT OR PERISH?

This new shift in value and transaction processes has created an environment where people have accepted a cashless life as the ‘norm’ seemingly overnight, without any objection or concern.

Many businesses and individual traders in Australia have been forced to adapt new paywave technology systems to accommodate for growing numbers of customers who reject businesses that no longer offer card payments – simply because they have no cash.

RELATED:

Australia’s rapid shift to digital

identification and licenses

Publishers in the printing industry, such as Big Issue, are now facing a crisis in sales which are vital to continue to fund services and support impoverished vendors across the country.

“Since tap-and-go has become prevalent in Australia, many of our vendors have found that people are carrying less and less cash, which is affecting their magazine sales,” says Big Issue COO, Sally Hines.

A recent article by the ABC also spoke with people about their experiences in the emerging cashless world, with one woman describing the experience of being asked by her children for coins:

“I got into a total panic the other morning,” says another caller.

“My kids’ kindy needed $7 and I just didn’t have it anywhere. I couldn’t even remember my pin when I got to the ATM.”

These are only a few examples that paint a picture of just how dependent Australians have become on digital payment systems.

Indeed, the cashless world is already here, and it seems as if it only remains a question of how long cash will remain logistically convenient in an ever-increasing, fast-paced global environment.

FUTURE DIRECTION

VULNERABILITIES

In May, National Australia Bank’s system experienced crashes for most of a busy Saturday, leaving customers stranded at checkouts and retailers unable to sell.

“We had that outage which caused chaos but in general people are trusting the system,” says Alan Oster, NAB chief economist.

Similarly, Commonwealth Bank suffered a 25-hour outage earlier this year that disabled credit cards and delayed payments, following similar outages in 2016 that affected both Commbank and Netbank applications.

ANZ also experienced a crash earlier in the year that left millions of customers without access to online and phone banking, limiting what they could pay for in a “technical disaster for the bank”.

RELATED:

Who really owns the

‘Big 4’ banks in Australia?

Outside of banking, we saw Woolworths services across Australia come to a halt earlier this year when a technical glitch forced stores to close after checkout payment systems had failed on a national level.

Despite this, consumers continue to adopt this kind of technology in increasing fashion, with the number of transactions using NAB Pay – NAB’s smartphone-based payment system – growing by 35 per cent each month.

Many have expressed concerns that if cashless payments are accepted as the new standardised form of payment in Australia, there will be no security (or ‘second option’) in avoiding future situations where these events occur, or safeguards protecting against proposed centralised e-commerce rules.

AUTOMATED WORKFORCE

The second major talking point associated with a transition to a cashless world is the future of the payment industry workforce, with many companies announcing major changes to policies, structure and procedures due to the rapid increase of digital technologies in the workplace.

In the transition to a cash-free world, NAB announced they will be firing over 6,000 staff across the country, and will be replacing them with 2,000 more positions – all in technology roles.

RELATED:

Visa polls Australians about

payments with RFID implants

NAB announced the changes late last year as part of a $1 billion cost-cutting initiative, which is driven by a plan to slash expenses while investing in new technology over the next three years, including by using automation to replace work done by people.

Andrew Thorburn, CEO of NAB, said the future facing banks was one in which “costs would need to be lower”.

The national secretary of the Finance Sector Union, Julia Angrisano, accused NAB of putting “technology and profits before people,” urging the bank to retrain staff rather than make workers redundant.

NAB’s move is the most dramatic change to employee numbers publicly announced by a major bank in recent years, leading some to believe this is only the beginning of a coming trend that awaits the remaining cashless world.

The word across the industry is that successful digital banks of tomorrow will be those that have built the right levels of digital skills within their ranks and automated those that carry ‘less value’.

COMMENTS

We are now the first generation to have no physical object that represents value: no bag of potatoes, no coins, no piece of paper.

A dollar will soon have no tangible representation, whatsoever. Money is now numbers in your account – and I can transfer them to you with a magical wave.

The speed of this social transformation is remarkable, and if history has taught us anything, it’s that people will immerse themselves in any kind of new magic discovered.

We are still not entirely metric just yet, but we have thrown away cash without even noticing.

Where will this road lead from here? Your guess is as good as ours.

FOLLOW US

For more TOTT News, SUBSCRIBE to the website for FREE and follow us on social media for more exclusive content:

Facebook — Facebook.com/TOTTNews

YouTube — YouTube.com/TOTTNews

Instagram — Instagram.com/TOTTNews

Twitter — Twitter.com/EthanTOTT

RELATED CONTENT

The Digital Economy – Milestones Report, June 2018 | Australian Payments Network

The Connected Continent II: How digital technology is transforming the Australian economy | Deloitte Access Economics

Australian digital economy valued at $79b | Australian Financial Review

Going cashless: the true cost of your empty wallet | ABC.net.au

Regulators are pushing us into a cashless world as RBA declares ‘a turning point has been reached’ | ABC.net.au

Digital trade worth $192b by 2030, push on for new global rules | Australian Financial Review

NAB reveals 6000 jobs to go as it announces $6.6b profit | SMH.com.au

Visa polls Australians about payments with RFID implants | TOTTNews.com

Who really owns the ‘Big 4’ banks in Australia? | TOTTNews.com

Is Australia on the brink of becoming a completely cashless society? | ABC.net.au

The ONLY winners of a Cash Free Society will be the Banks & Govt. I cannot understand how the majority of Australians could be so stupid not to want & use Cash for at least some transactions. Image in the Future without cash money.

The power goes off & or you’re in a remote area & NO access to the I/Net. Without Cash $ you can’t purchase anything – If off for a long time – You’re stuffed !

Banks can & do charge what they like — currently charging Businesses often well over 1.3 % for every transaction. Charging customers 3% to access cash from Credit Card + 20% interest ! This while paying SFA or around .25% Interest if lucky ! Imagine their Glee & the charges in a Cash free World. Freedom Lost. We all saw the depravity & greed of the Banks during the so called Royal Commission. They’re back to doing what they want. Remember –ALL Banks are Bastards.

As for Govt – A cashless society would be a Wet Dream for Govt. If you play up or become a nuisance they could deny access. Accounts could be frozen without a reason having to be given. They would have unlimited overview of your affairs. If this push for cashless is NOT fought strongly the people of Australia are finished as a Free Society. Please keep up the good work informing the populace.